Introduction

Van Insurance is rising!

While most motorists in the UK are seeing their car insurance premiums decrease, what about van drivers?

Recent data shows a significant surge in van insurance costs, which is causing concern among commercial vehicle owners.

This rise is in sharp contrast to the overall decline in car insurance rates.

But why is this happening?

- Rising Costs: Understand how van insurance premiums have increased over the past year.

- Age Impact: Discover the disproportionate effects on middle-aged van owners.

- Usage Influence: Explore how the purpose of van use influences insurance pricing.

- Looking Ahead: Consider the potential of telematics-based policies and effective shopping to mitigate rising costs.

Read more about van insurance trends.

The Current Landscape Of Van Insurance Costs

What’s driving these changes?

According to the Consumer Intelligence Van Insurance Price Index, there’s a noticeable divergence between car and van insurance costs.

While the average car insurance premium fell to £834, marking a 16% decrease, van insurance rates have moved in the opposite direction.

Isn’t that intriguing?

This division underscores the unique market dynamics affecting van insurance, which are influenced by factors like vehicle use and risk assessment.

Additionally, claim rates also play a crucial role in shaping these dynamics.

Age-Related Trends In Van Insurance Pricing

But what does age have to do with it?

It appears the rising insurance costs are not evenly distributed among van drivers.

Middle-aged drivers, those aged 25 to 49, are hit hardest, experiencing an 8.4% increase over the last year.

Conversely, drivers over 50 saw a less steep rise of 4.7%.

And what about younger drivers?

They saw only a 1.1% increase, though they generally face higher rates overall.

See more details on how age affects van insurance costs.

The Influence Of Vehicle Usage On Insurance Costs

How exactly does usage impact costs?

The purpose for which van drivers use their vehicles significantly affects their insurance rates.

Those using their vans for personal or social purposes have faced the largest increase, with rates rising by 3.2%.

Doesn’t this make you wonder how insurers calculate risk?

This suggests that insurers assign a higher risk premium to vans used beyond traditional commercial activities.

Likely, this is due to perceived increased risks of damage or theft.

Discover how different uses impact insurance costs.

Regional Differences In Insurance Premiums

What about the effect of your location?

Although national averages provide a broad overview, regional variations can significantly affect van insurance costs.

In regions characterised by higher theft rates, frequent accidents, or varying economic conditions, insurance rates are likely to differ significantly.

Understanding these regional differences is crucial for van owners navigating the complex landscape of insurance pricing.

Read about regional insurance variations.

Forecasting Future Insurance Costs For Van Drivers

Is there a silver lining?

Despite the current rise in prices, there’s hope on the horizon.

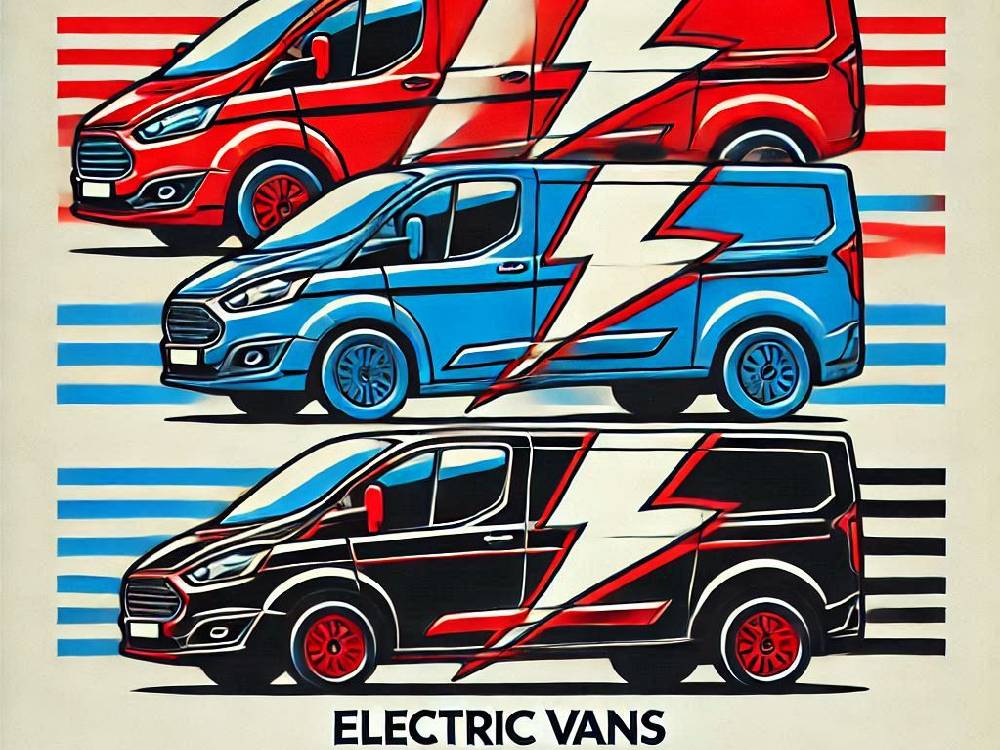

Advancements in insurance technology, especially the introduction of telematics-based policies, could help stabilise or reduce premiums in the future.

These policies enable insurers to customise rates based on actual driving behavior, thereby offering fairer pricing for responsible drivers.

Consequently, this approach could potentially reverse the trend of rising costs.

Explore the future of van insurance with telematics technology.

Are You Getting The Best Deal?

So, what can van drivers do to combat rising insurance costs?

It’s crucial not to accept the first renewal quote you receive.

If possible, shop around – it could make a substantial difference.

Have you checked how secure your van is lately?

Improving security features can also lead to lower premiums.

Why not see what changes you can make?

Find out how enhancing your van’s security can save you money.

The Impact Of Telematics On Van Insurance Costs

Curious about how technology is reshaping insurance?

Telematics-based policies are not just a buzzword; they are a potential game-changer for van insurance.

By monitoring driving behavior, these policies could significantly lower your rates.

But how exactly does this technology work, and what does it mean for you?

Planning Ahead: When To Shop For Van Insurance

Did you know timing is everything when it comes to insurance?

Starting your search for a new policy about a month before your current one expires can lead to the best rates.

Insurers view well-organised drivers as lower risk, which might translate into savings for you.

Why wait? Start marking your calendar today.

Discover the best times to shop for van insurance.

Conclusion

As we’ve seen, van insurance costs are on the rise, but that doesn’t mean you’re powerless.

By understanding the factors that affect premiums and using the tips we’ve discussed, you can take control and find a better deal.

Remember, being proactive is key.

Looking for more insights and tips?

Check out our other articles on van insurance and stay ahead of the curve.

The importance of van insurance

Van insurance for the future: How SafePay attacks change the game