Introduction

Drivers need to stay compliant to save on van insurance.

Declaring speedometer settings in mph, along with disclosing advanced driving systems, are both crucial updates.

Moreover, these changes are necessary for ensuring compliance.

Furthermore, these changes are crucial for ensuring compliance and upholding legal standards.

The DVSA just rewrote the rules for van drivers – and what you don’t declare could now cost you more than you think.

Getting your van road-approved in 2025 has become significantly more complicated.

The DVSA has updated its Individual Vehicle Approval (IVA) process – and if you drive a van, import vehicles, or operate a small fleet, this matters.

Why?

Because what you declare – or fail to – can now affect whether your van is certified as roadworthy.

Getting your van road-approved in 2025 has become significantly more complicated.

Here’s a quick breakdown:

Let’s break this down.

What Has Changed?

The DVSA (Driver and Vehicle Standards Agency) has introduced a wave of reforms for the IVA process.

Effective from 14 May 2025, drivers applying for IVA certificates for cars (M1) and vans (N1) will face a new set of questions – and responsibilities.

The biggest change?

Applicants must now explicitly declare that their vehicle’s speedometer is set to mph, as required by the new regulations.

That might sound minor.

But it’s not.

Previously, this would have been physically checked as part of the inspection.

Now, you can self-certify.

Sounds easier, right?

Not exactly.

Miss this step, and you could be forced to start your IVA process again.

This applies to new applications only, so if you’ve already submitted an IVA form before the deadline, you’ll still go through the old process.

The rules are specifically for small volume or individual vehicle imports and builds – meaning it hits self-builders, importers, and traders hard.

Read more about why proper vehicle compliance is crucial for road safety.

Why It Matters For Van Drivers

If you’re a van driver in the UK, this isn’t merely red tape.

In fact, it’s crucial regulation that could, in turn, stall your business, delay deliveries, or even invalidate your cover.

Self-employed tradespeople and small business owners are especially at risk.

Most won’t even realise the rules have changed until something goes wrong.

That’s when things get expensive.

Incorrect or missing declarations could, therefore, result in test failure, which may require a return visit and lead to additional fees.

Worse still, if your van isn’t certified correctly, it could also affect your insurance.

Because if your vehicle doesn’t meet DVSA standards, insurers may refuse to pay out in the event of a claim.

Scary, right?

Make sure you know the difference between driving a car or a van for insurance purposes.

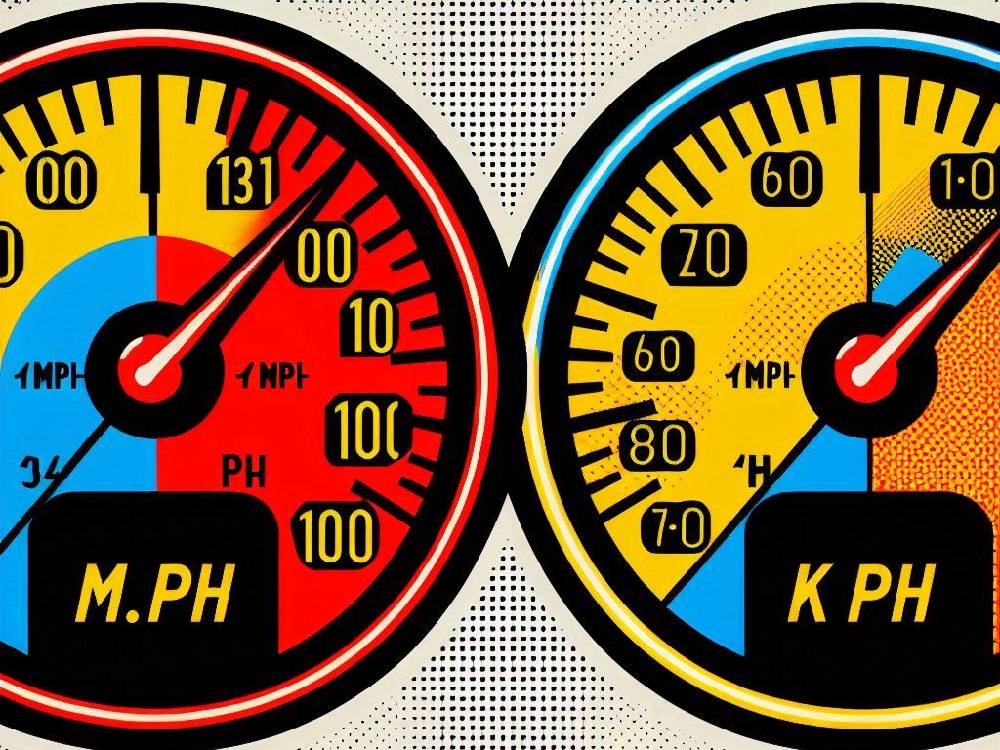

Mph vs Kph – Speedometer Compliance Explained

Under the new DVSA rules, vehicles must now be fitted with speedometers that read in mph.

Consequently, this change aligns with Section 17 of the IVA inspection manual, which was updated in late 2024.

So what counts as compliant?

- Speedometers that read mph only

- Displays that show both mph and kph

- Digital systems that let you switch between mph and kph

What doesn’t count?

A speedo that only displays kph.

That’s a fail.

Plain and simple.

Many imported vans from Europe fall into this trap.

Moreover, if you’re modifying a van, adding a compatible mph display should be an essential part of your checklist.

Need help understanding van modifications? Check out what counts as a modification for van insurance.

Autonomous Systems & Drive-by-Wire Features

Let’s talk about future tech.

The DVSA has added new questions to its IVA application forms regarding autonomous and drive-by-wire systems.

What does that mean?

You must now declare whether your van:

- Has conventional pedals, gearstick, and steering

- Uses electric signals instead of mechanical controls (aka “drive-by-wire”)

- Features any form of self-driving or semi-automated tech

This is part of a wider move to regulate the growing number of advanced vehicles on UK roads.

The future isn’t just coming.

It’s already here.

If you’re operating a hybrid or electric van, you’ll also need to complete a newer version of the form.

Want to lower your premium while keeping your tech? Learn how telematics devices can save you money.

Who Needs To Act Now?

This is not a situation where you can afford to wait and see.

If you are applying for IVA approval from 14 May 2025 onwards, immediate action is required.

You must comply with the new rules.

However, if you’ve already submitted older forms, don’t worry — your application will still proceed under the previous system.

But, if your application is still pending or just beginning, you’ll need to complete the new forms, which now include updated declarations.

Still using an outdated form?

Stop right there.

It will no longer be accepted after 10 June.

It’s important to note that these changes do not apply to:

- Lorries (N2/3) or buses (M2/3)

- Vehicles with mph-only or dual-marked displays

- Vans with switchable settings for kph/mph

For everyone else, however, now is the time to act.

If you’re just starting as a van owner, be sure to read more about getting van insurance as a new driver.

The Van Insurance Angle

Let’s cut to the chase.

Your compliance with DVSA regulations can have a direct impact on your van insurance premiums.

How, you ask?

Simply put, insurers are increasingly relying on regulatory data when assessing risk.

Fail your IVA test?

That’s a red flag.

Use the wrong application form?

It could be seen as negligence.

And insurers?

They don’t appreciate surprises.

Non-compliance is a big one.

That’s why smart van drivers consistently stay ahead of the rules.

In fact, staying ahead often leads to lower insurance premiums.

If you’re looking to secure the cheapest van insurance, it’s important to consider more than just your driving record.

Pay attention to your paperwork as well.

Want exceptionally cheap van insurance?

Compliance isn’t just an option — it’s a strategic move.

Conclusion

In short, the DVSA’s new IVA rules are already in effect.

If you’re a van driver in the UK, you can’t afford to overlook them.

From declaring speedometer settings in mph to, more importantly, disclosing advanced driving systems, these updates are undeniably crucial.

They significantly impact your roadworthiness, legal standing, and insurance eligibility.

Act now.

Double-check your forms.

Make the correct declarations.

Avoid unnecessary delays.

Stay compliant.

Stay covered.

Be smart.

For more crucial updates, take a look at:

Navigating The Soaring Rise In van Insurance Costs