Introduction

Van Insurance Safety Warning.

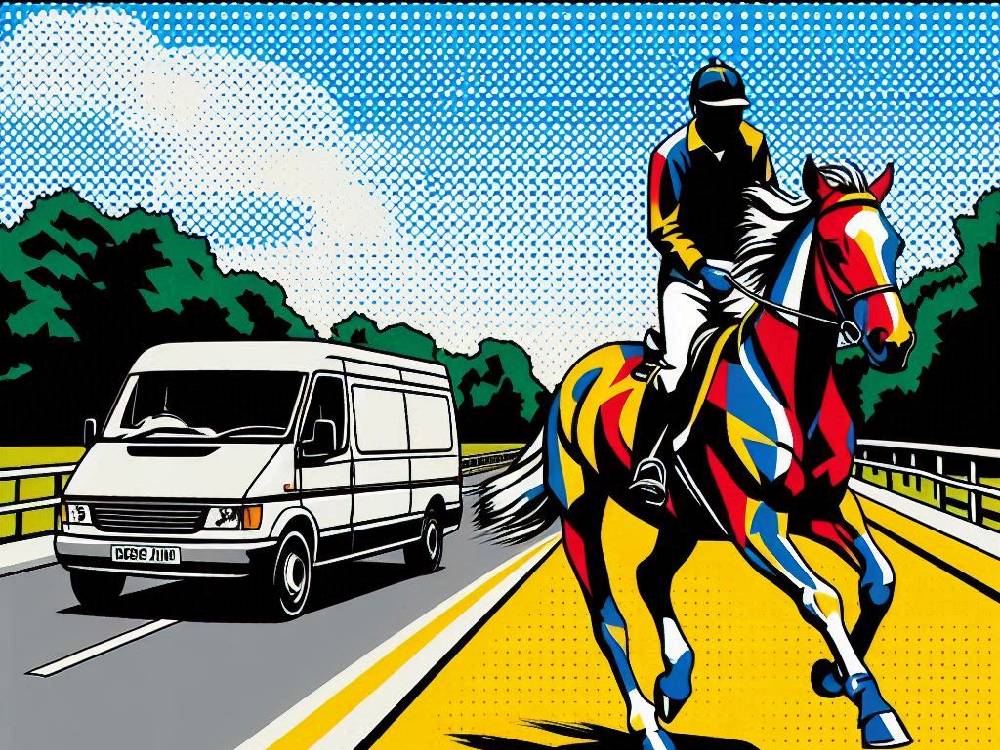

While most drivers think rural roads are the safest, they’re often the most unpredictable.

In fact, failing to drive with care on these roads can cost you far more than just a fine — it could strip you of your licence and destroy your van insurance premiums.

One van driver ignored safety guidance near horses and paid the ultimate price: the court convicted him, banned him for six months, and insurers raised his premiums sky-high.

Because of this case, North Yorkshire Police issued a stark warning to every UK motorist:

Slow down near horses, or suffer the consequences.

Here’s what you’ll learn in this article:

The Incident That Sparked The Warning

A Van.

Two Horses.

And One Reckless Decision.

To begin with, let’s look at what actually happened.

In September 2024, while driving a white Ford Transit Custom near Northallerton, a man encountered two horse riders on a narrow country lane.

At that moment, instead of slowing down, he made a split-second choice that would change everything.

Instead of slowing down, he drove past them at speed — failing to show caution, distance, or even basic courtesy.

Worse still, this wasn’t just careless.

It was captured on video and sent directly to the police.

But that’s not the whole story…

When officers contacted the man, they discovered he had no insurance.

And he wasn’t wearing a seatbelt either.

So in addition to the incident with the horse riders, he was prosecuted for two further offences.

At Harrogate Magistrates’ Court, he admitted to all three charges.

What followed was swift and severe:

- A £709 fine

- 14 penalty points

- An automatic six-month driving ban

“When drivers fail to act responsibly near horses, the consequences go beyond simple inconsideration — they can, in fact, become life-threatening,” said a police spokesperson.

In other words, this wasn’t a slap on the wrist.

It was a career-altering, policy-wrecking blow.

And if you think your own policy would survive such a hit, think again.

Think Van Insurance Safety Warning.

If you’re serious about protecting your cheap van insurance, this case is a crystal-clear warning.

Van Insurance Safety Warning: Why Rural Driving Needs Extra Caution

Aggressive Drivers Struggle on Country Roads

Now, let’s talk about the environment where this all happened.

Rural lanes might appear calm, but they often hide serious hazards.

Unlike city roads, which are designed for visibility and traffic flow, country roads are:

- Narrow and winding

- Frequently obstructed by trees or hedges

- Home to horses, cyclists, walkers, and farm machinery

Because of these conditions, drivers need to be far more cautious — especially those operating heavier vehicles like vans.

But here’s what many van drivers forget…

The temptation to speed or overtake aggressively on empty lanes can be strong.

However, doing so places everyone at risk.

When you approach a horse rider at 30mph without warning, you’re not just breaking the law — you’re gambling with someone’s life.

Furthermore, the Highway Code is clear: drivers must slow to 10mph, pass with 2 metres of space, and avoid any sudden noises.

Still, far too many drivers ignore this.

That’s why North Yorkshire Police issued a reminder after the incident:

“We cover 3,200 square miles with 6,000 miles of roads. Many are used daily by horse riders. Motorists must respect that.”

In simple terms, driving carelessly isn’t just a mistake —

It’s a fast track to penalty points, insurance hikes, and public danger.

For more on this, read Why proper vehicle compliance is crucial for road safety.

Van Insurance Safety Warning: Why Reckless Driving Hits Your Wallet Hard

Your Licence Isn’t the Only Thing You Could Lose

Let’s take a step back.

What does a moment of carelessness actually cost?

More than most drivers realise.

Once you receive penalty points, insurers begin to see you differently.

Not only do they flag you as high risk, but they often raise premiums immediately — or refuse to renew your policy altogether.

Driving uninsured or failing to wear a seatbelt sends an even louder signal.

It tells insurers you’re unpredictable.

It tells them you’re a liability.

And unfortunately, that means you’ll pay a heavy price — every year, for years.

Consider this…

Even a simple parking error can affect your rates.

So imagine how serious insurers get when you’re fined for dangerous driving.

To see how one mistake nearly doubled a premium, check out:

How one parking error nearly doubled a driver’s insurance

Now multiply that by three offences and a ban.

That’s how you go from a very cheap van insurance quote to a nightmare renewal letter.

And just in case you’re wondering…

Yes, insurers share this information.

Yes, it stays on your record.

And yes — it could limit your options for years to come.

Understanding The Highway Code Rules For Horse Safety

These Aren’t Suggestions — They’re Legal Expectations

Before we go any further, let’s break down what the Highway Code explicitly says about sharing the road with horses.

Because if you skip this part, your next mistake could be your last legal one behind the wheel.

Here’s what you must do when approaching horses:

- Slow down immediately — reduce your speed to 10mph or less

- Pass wide and slow — leave at least 2 metres of space

- Avoid noise — do not rev your engine or sound your horn

- Be patient — only overtake when safe and clear to do so

Fail to follow these, and you don’t just risk causing panic or injuring a rider —

You risk facing charges.

And from an insurance perspective, that’s a nightmare scenario.

Want to know how other infractions can wreck your premium?

Read: What every van driver must know about insecure loads and seatbelts

Real Life, Real Consequences, Driving Ban. Van Insurance Safety Warning

£709. 14 Points. 6 Months Off the Road.

So let’s recap the situation.

The driver failed to slow down near horses.

Didn’t wear a seatbelt.

Wasn’t even insured.

And while those penalties are harsh on their own, they’re only half the damage.

Because now, every insurer will see him as a repeat offender.

Every quote he receives will reflect his past choices.

And every renewal will remind him of what one afternoon cost. Even worse?

He’ll likely need specialist insurance, which is notoriously expensive.

So if you’re wondering whether these offences truly follow you…

They do.

The Bigger Picture: Could This Happen To You?

Yes. And Much Sooner Than You Think.

Let’s stop pretending this story is rare.

Because the reality is, many van drivers have already made similar mistakes —

They just haven’t been caught yet.

That’s why you should ask yourself:

- Do you regularly check your policy is valid?

- Have you read the latest Highway Code updates?

- Are you confident you’re legally compliant when driving rural routes?

If the answer to any of those is “no” or “I’m not sure,” then your next mistake could be your last insurance discount.

Take a moment and learn from other costly driver oversights:

What counts as a modification for van insurance?

Ultimately, it’s not just about fines or bans.

It’s about your freedom to drive, to work, to earn —

And whether your van insurance policy is still valid when it matters most.

It’s a Van Insurance Safety Warning.

Conclusion

To sum up, this story isn’t just a legal case — it’s a wake-up call.

Because ignoring the Highway Code, especially around vulnerable road users like horses, doesn’t just endanger lives.

It wrecks your insurance profile.

It destroys your driving record.

And it leaves you uninsurable or massively out of pocket.

So before you hit the road again, ask yourself:

“Would I be proud to show this journey to a courtroom… or to my insurer?”

If the answer is no, then it’s time to change how you drive — before your policy changes for you.

This is your Van Insurance Safety Warning

Explore More Essential Reads

- 10 Simple Hacks to Instantly Lower Your Van Insurance

- How telematics devices can save you money on van insurance

- Are you driving a car or a van? Check your insurance policy